Your 401k is a bad teacher and a great investment tool

Nov 03, 2020Your 401k is a poor educator and a great investment tool. I tell clients it is probably best to max out the 401k before they think of any ‘new’ investments. The money is tax deductible, gains are tax-deferred until retirement, some employers make a nice match, and the funding is usually automatically deducted from your paycheck. Pretty sweet.

So what’s the problem?

Unfortunately, this arrangement could give you an unhealthy view of investing. Instead of focusing on the current and future earnings power, dividends and interest income of your holdings, you will be focused on the portfolio’s value according to Mr. Market. Why? Because the dividends are reinvested and monies cannot be distributed without penalty in most cases until retirement age. It is a ‘walled off’ account for forty years or so with no pick me up for you, the investor, to get excited about investing. Maybe congress should amend the 401k rules to allow for a tax free $ 1,000 distribution if you max out your account five years in a row. I’m being a little silly here, but I hope you get the point. Investing with no immediate payoff for 40 years can be a tough pill to swallow for most.

If your 401k is your only investment vehicle, you might miss the magic and simplicity of passive income from dividends or interest. The idea that money can be made in your sleep and used to pay your bills can be a strong incentive to invest, and orient you to a proper conception of investment. I fear that some are obsessed with the value of their portfolio day to day and not its income producing power for this very reason.

Let me explain:

Suppose you come across $ 1,000 that you are able to invest. You then wisely invest that money in an index fund instead of buying half of a World Series ticket. You will receive about $ 20 a year paid out quarterly for this decision. (Assuming a 2% dividend yield) This means you will receive about $ 5 every three months, potentially forever. You can then send these funds to your checking account and use it to pay for a smoothie once a quarter. A smoothie every three months for the rest of your life, now that is exciting investing! You receive this arrangement with no draw down of the original $ 1,000.

The lesson:

Consider the income produced, not the supposed increase or decrease in value of the underlying investment. Don’t chase yield when you do this. It will be tempting to turn that 2% into 5% by increasing your risk. This ‘yield trap’ deserves another post.

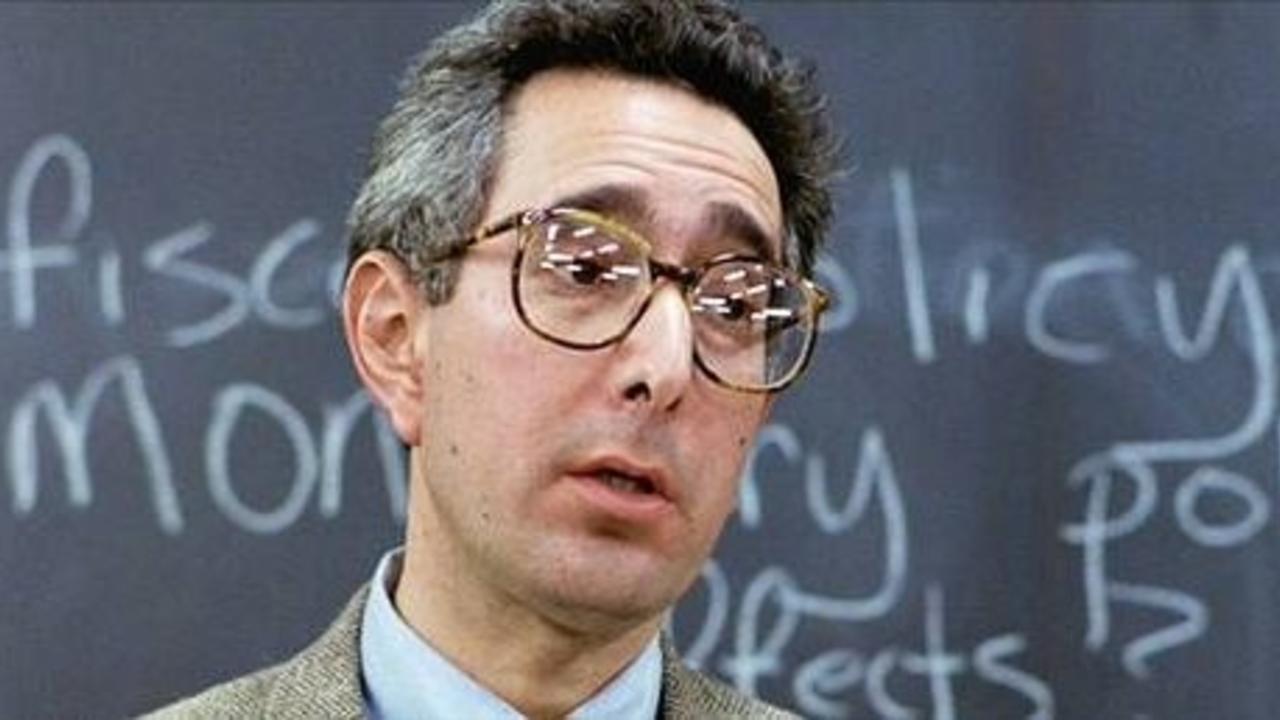

In summary, a 401k is great, just be sure in your utilization of this great tool, you ignore some of it’s lessons. Who knew ignoring a lesson could be so good for you? Bueller, Bueller, anyone?