Take the red pill - Your future self will thank you

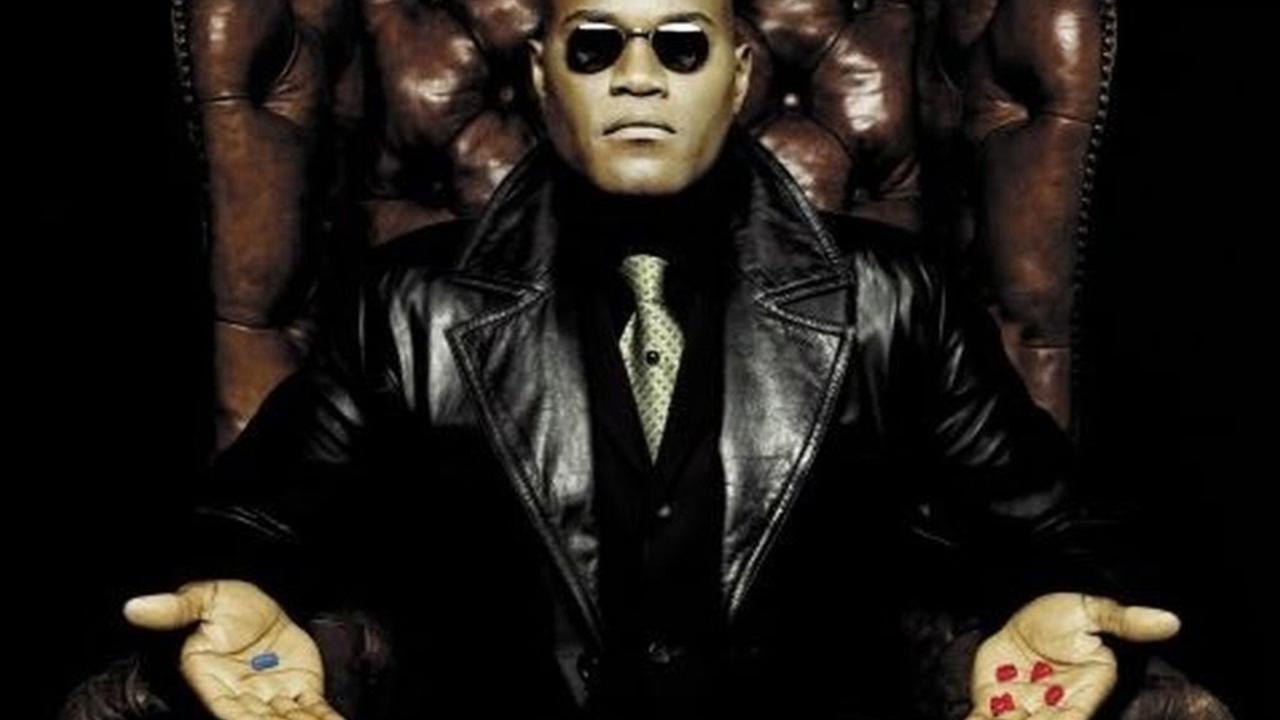

Nov 02, 2020I’m considering adjusting my initial meeting with clients to be a slight modification of Neo’s encounter with Morpheus in the Matrix:

Me (Morpheus): “You stick with your current high cost, complex investment strategy, the story ends. You wake up in your bed and believe whatever you want to believe about how costs and taxes effect your portfolio. You partner with me, you enter personal finance reality, and I will show you how deep the rabbit hole goes.”

A tad dramatic I admit, but you should definitely take the red pill. One step toward this end is reading what the greatest investor of all time is going to invest in for his wife when he passes away.

The oracle of Omaha, Warren Buffett, directs that his wife's trustee invest accordingly:

Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors – whether pension funds, institutions or individuals – who employ high-fee managers.

The whole letter (link below) is worth a read and will take you a little further down the rabbit hole: