A list of my investing mistakes

Nov 18, 2020I did not begin my investing journey with the conviction that low-cost index products were best for most folks. Quite the contrary. I started out as most do. I did not know what I did not know. As a result, I made a number of investing mistakes. I have provided a sampling of those mistakes for your entertainment/education:

1999: At 14 years old I had my mother call a broker and invest in Internet America (geek) stock for me. I was caught up in dot com mania like everyone else. My holdings doubled, but I was wary of making my mom sell and the stock subsequently crashed. I lost most of the investment.

My lesson: Don’t outsource trade execution and don’t speculate on internet stocks

2004: Now 18 and able to invest on my own, on a ‘stock tip’ I invested in Genitope (gtop). It was a biomedical company with a promising drug to treat cancer. After the holdings went up 20% I sold. It later crashed to 0.

My lesson:

- Don't take stock tips

- The FDA can crush a company and drug development is risky.

- My ‘success’ seemed difficult to replicate.

2007: I invested in unsecured consumer loans on the Prosper marketplace. The high yielding notes enticed me. I lost a small amount of money over a three year period, but I spent a decent amount of time researching the loans.

My lesson:

- Spending a bunch of time on due diligence does not ensure success.

- Unsecured debt investing is very risky

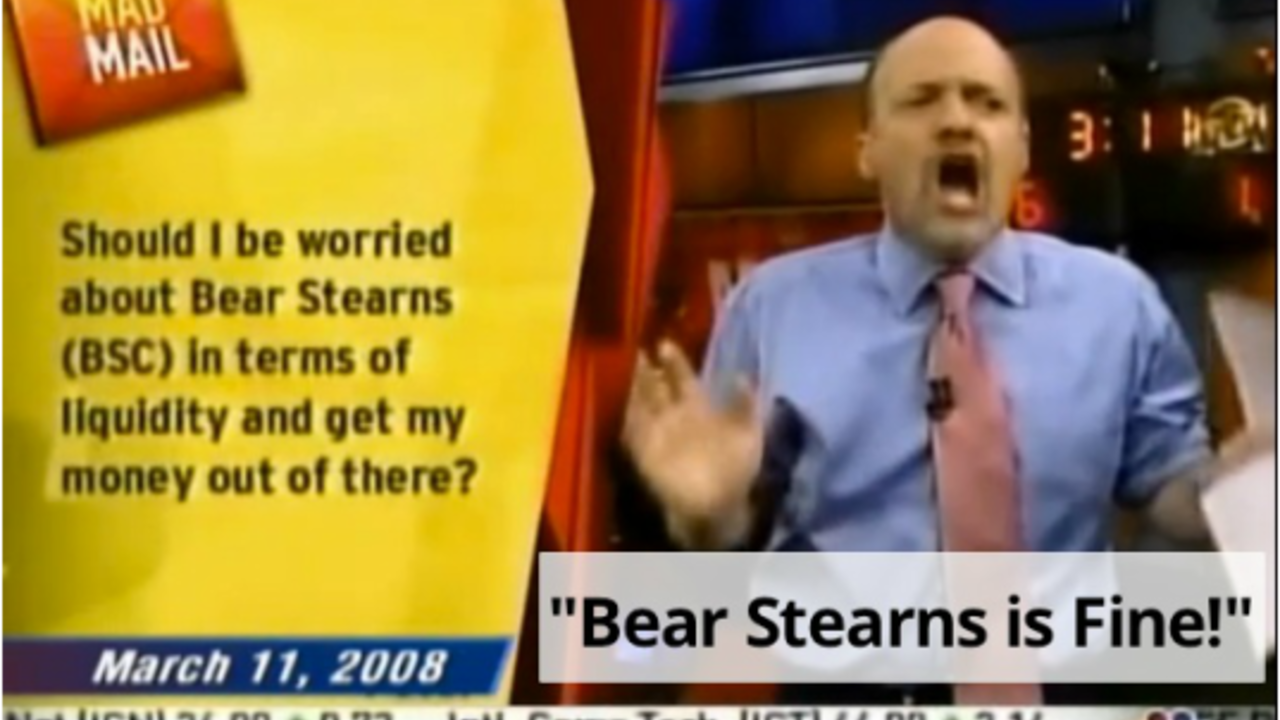

2008: I invested in American Capital after the stock had dropped over 50% and the CEO seemed to think things were fine. It kept dropping after I invested and although I held on for the recovery, I still lost 50% of the investment after selling a few years later.

My lesson:

1. It is tough to ‘catch a falling knife’

2. Part of a CEO’s job is to promote their stock.

3. Don’t chase yield

4. Due diligence does not ensure success

There is plenty more to write here (sadly), but I think you get the picture. Making financial mistakes was painful, but very instructive for me. I always used relatively small amounts of money limiting the devastation of the mistakes while still receiving a great financial education.

The takeaway:

Before hiring a financial advisor, ask them what mistakes they have made. You can learn a lot about someone depending on their answer.